dependent care fsa eligible expenses

While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. His employer pays directly to his dependent care provider an additional 1000 under a qualified dependent care benefit plan.

What Is A Dependent Care Fsa Wex Inc

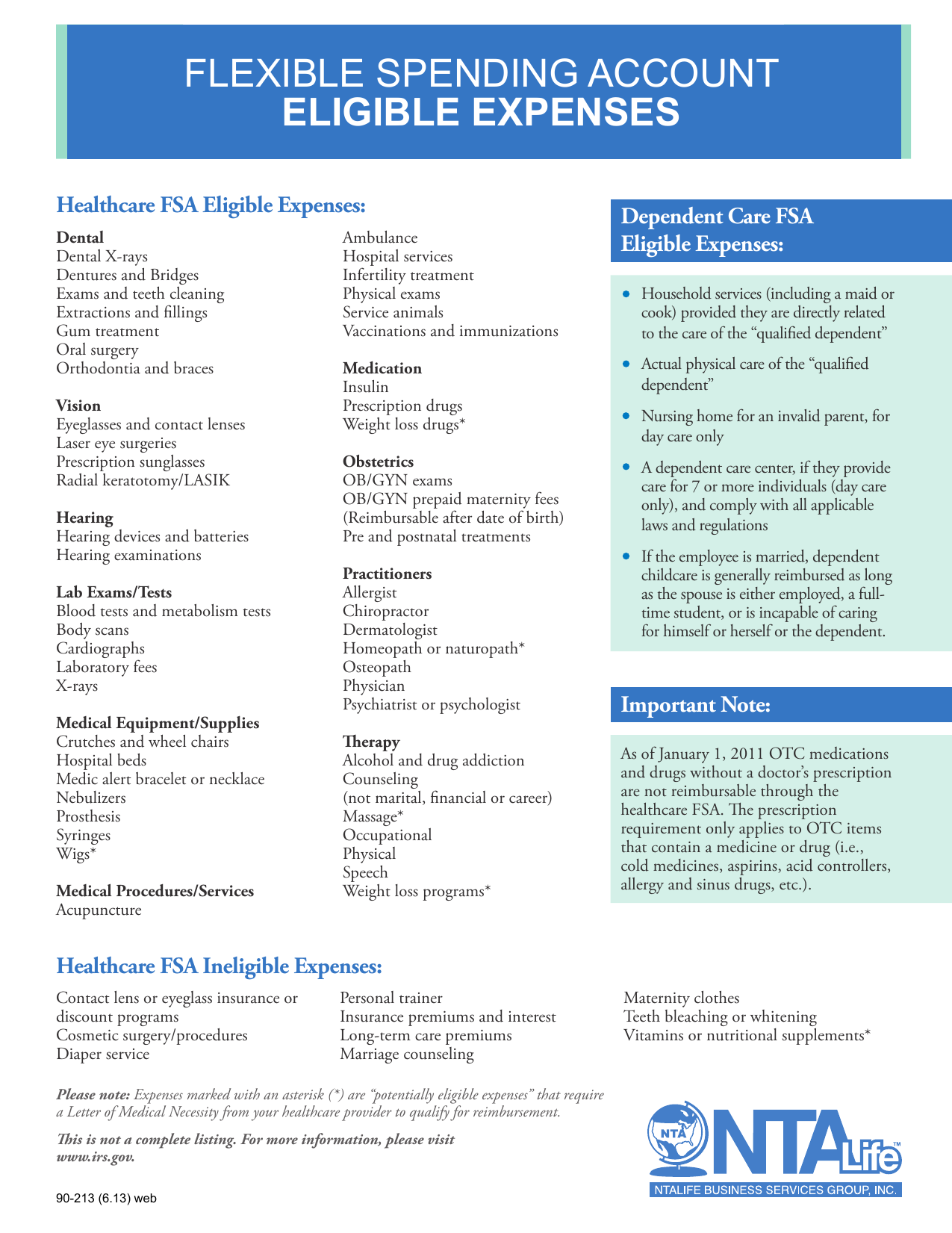

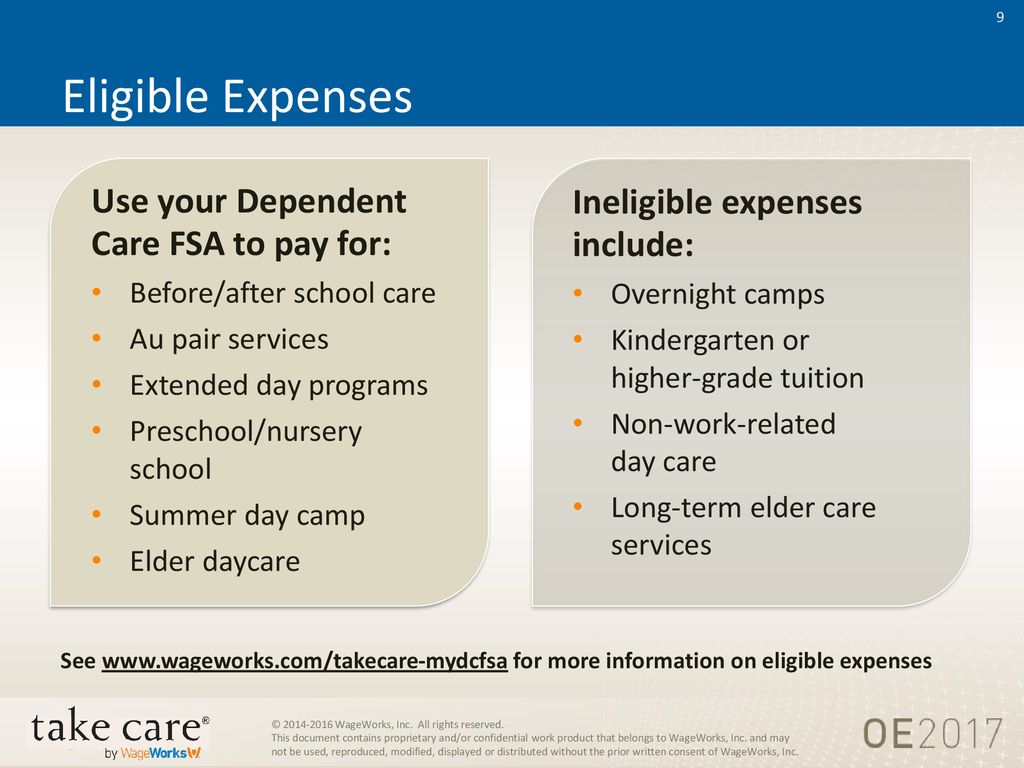

Dependent Care FSA Eligible Expenses.

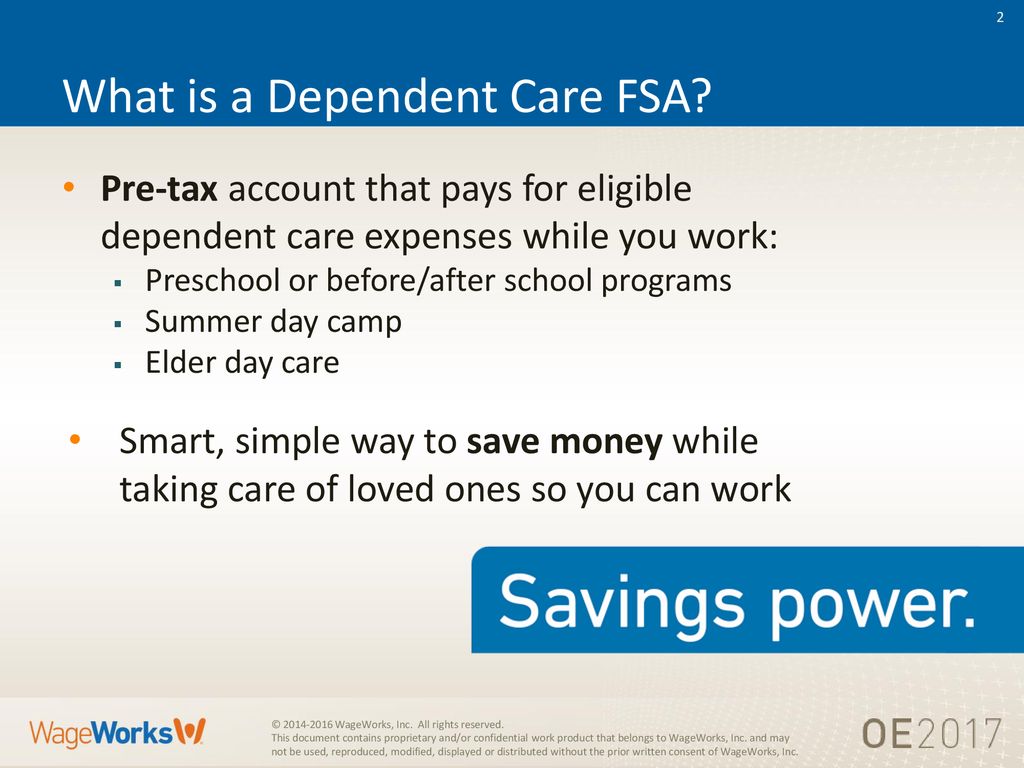

. Generally under these plans an employer allows its employees to set aside a certain amount of pre-tax wages to pay for medical care and dependent care expenses. A spouse who is physically or mentally unable to care for himherself. Its a smart simple way to save money while taking care of your loved ones so that you can continue to work.

Expenses for non-disabled children 13 and older. What Is a Dependent Care FSA. The minimum and maximum amounts allowed to be contributed to a DCFSA are.

A dependent daycare FSA is designated for expenses incurred to care for your children age 12 and younger as well as your adult tax dependents who are unable to care for themselves while you are at work. Educational expenses including kindergarten or private school tuition fees. Its goal is to help cover the costs of providing professional care so that the caregiver can work look for work or attend school full-time.

Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. The IRS determines which expenses are eligible for reimbursement. Common FSA eligibleineligible expenses.

A family using an FSA to cover qualifying expenses can save thousands of dollars every year with little downside. Over-the-counter drugs such as cold and allergy medicines pain relievers and. If a care provider takes a qualifying person to or from a place where dependent care is provided those expenses may be eligible for reimbursement.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. You can use your WageWorks Dependent Care FSA to pay for a huge variety of child and elder care services. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits.

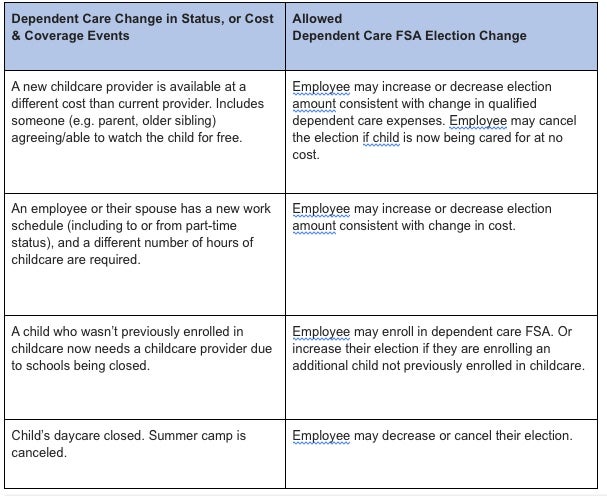

You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. 16 rows Various Eligible Expenses. Allow employees to establish revoke or modify health or dependent care FSA contributions mid-plan year on a prospective basis during calendar year 2020 and 2.

A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves. The Savings Power of This FSA. What expenses are covered.

In order to take a distribution from the dependent care FSA for a parents dependent care expenses the parent must be a tax dependent under IRC 152 as modified by 21 b 1 B who is a physically or mentally incapable of caring for himself or herself and b has the same principal place of abode as. While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. Dependent Care Tax Credit.

Keep in mind that you cannot claim the same expenses for the Dependent Care FSA and the tax credit. Expenses that are eligible for the Dependent Care FSA can also be eligible for a tax credit on your federal tax return. Learn more about the benefits of a dependent care FSA with PayFlex.

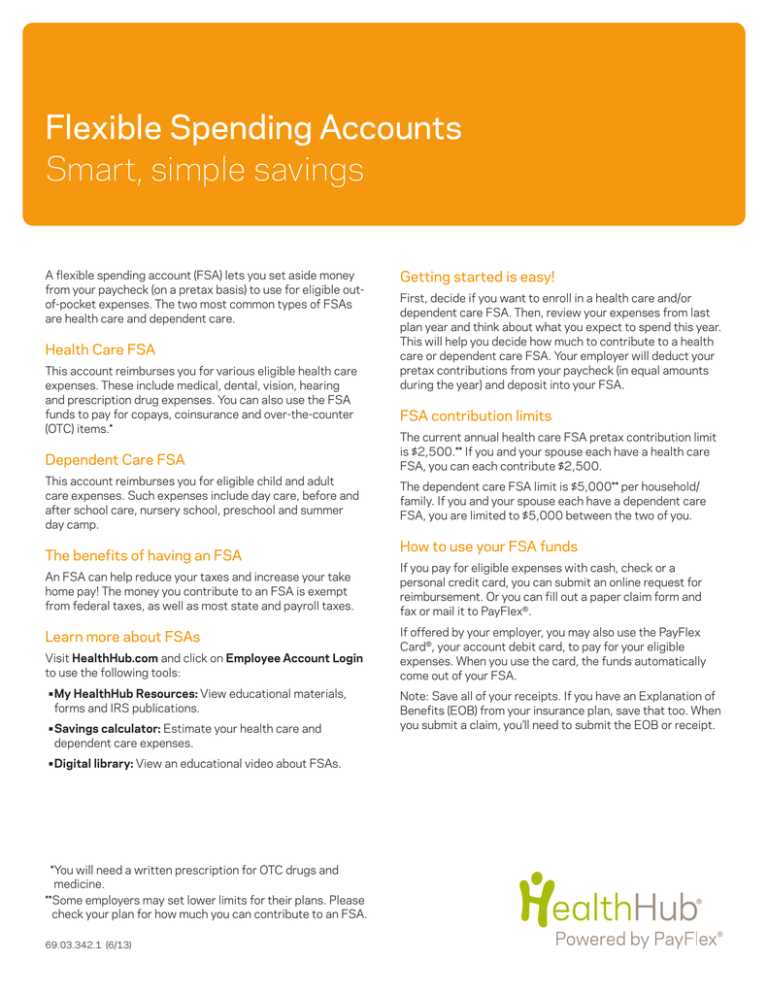

Common qualified expenses that a health care FSA will usually cover include the deductible coinsurance or copayment amounts for your health plan eye glasses or contact lenses dental work and orthodontia medical equipment hearing aids and chiropractic care. For a full list of eligible expenses see IRS Publication 503 Child and Dependent Care Expenses. A dependent care FSA is a unique employee benefit that allows workers to set aside pretax dollars to pay for eligible care expenses for a child disabled spouse elderly parent or other individual listed as a dependent who is physically or mentally incapable of self-care.

For a dependent care expense to be eligible for reimbursement from a Dependent Care FSA the care must be to enable you and your spouse to work actively look for work or attend school full-time. The IRS has outlined the following items as not being eligible for tax-free purposes using Dependent Care FSA funds including. Your family is completely taken care of while youre busy on the job.

A dependent care flexible spending account DCFSA is an employer-provided tax-advantaged account for certain dependent care expenses. Dependent Care FSA Eligible Expenses. Children under the age of 13.

The IRS limits the total amount of money you can contribute to a dependent-care FSA. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and 2021. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or after school programs and child or adult daycare.

Dependent Daycare Eligible Expenses. You can use your Kazdon Dependent Care FSA to pay for a huge variety of child and elder care services. Unfortunately not all dependent care FSA expenses are covered.

The Internal Revenue Service IRS decides which expenses can be paid. He pays work-related expenses of 7900 for the care of his 4-year-old child and qualifies to claim the credit for child and dependent care expenses. Learn more about how much you can save what it covers and how.

To be considered qualified dependents must meet the following criteria. Deposits registration fees and application fees required to obtain care are eligible. The following lists are not all-inclusive.

You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services. The IRS determines which expenses are eligible for reimbursement. Any adult you can claim as a dependent on your tax return that is physically or mentally unable to care for himherself.

This document can be used to help you determine which expenses may be eligible for reimbursement under your Health Care or Dependent Care Flexible Spending Account FSA. Dont pay full price get the tax-advantaged rate. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including preschool nursery school day care before and after school care and summer day camp.

This list is not meant to be all-inclusive. George is a widower with one child and earns 60000 a year. It pays to learn the Dependent Care Flexible Spending Account FSA rules if you have a spouse not working or your child participates in programs that test the boundaries of IRS eligibility.

Common examples include deposits required to reserve a place for a child at. The IRS determines which expenses can be reimbursed by an FSA. For a complete list of qualified dependent care expenses see IRS Publication 503.

Allow unused funds remaining in a health or dependent care FSA at the end of a grace period or plan year ending in 2020 to be used to pay or reimburse expenses incurred. Qualified dependent care expenses. If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or.

Actively looking for work means researching and applying for jobs attending interviews or related activities. September 16 2021 by Kevin Haney. Cover expenses for your childdependent.

While this list shows the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. Dependent Care FSA for Parents.

The Dependent Daycare FSA allows certain out-of-pocket daycare costs to be paid on a pre-tax basis. The IRS determines which expenses are eligible for reimbursement. While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive.

The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for. A dependent care FSA DCFSA provides tax savings for the care of your children a disabled spouse or legally dependent parent during your working hours.

Your Handy List Of Fsa Eligible Expenses Employers Resource

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

How To File A Dependent Care Fsa Claim 24hourflex

Flexible Spending Accounts What Are They How Do They Work How Can I Enroll For 2014 Pdf Free Download

How A Dependent Care Fsa Can Enhance Your Benefits Package

Why You Should Consider A Dependent Care Fsa

Flexible Spending Accounts Smart Simple Savings Getting Started Is Easy

Your Flexible Spending Account Fsa Guide

Health Care And Dependent Care Fsas Infographic Optum Financial

2021 Wake Forest Benefits Guidebook By Wfu Talent Issuu

Dependent Care Fsa Flexible Spending Account Ppt Download

Flexible Spending Accounts Fsa 2020

Dependent Care Fsa Flexible Spending Account Ppt Download

File A Dca Claim American Fidelity

Dependent Care Open Enrollment 24hourflex